Broadway, Worcestershire

Art Deco style brooch with mother of pearl set in silver and marcasite.

Southampton, Hampshire

Art deco long multi-coloured speckled ceramic beaded necklace possibly 1920s very pretty.

Aberdeen, Scotland

Vintage Art Nouveaux large Clear Swarovski style Crystal Necklace Pendant. Dimensions 38mm x 22mm. For sale £21.

Swansea, Swansea

Pretty art deco vintage ladies earrings good Condition buyer Collects Ystradgynlais, Swansea Valley sorry no offers.

Bournemouth, Dorset

Antique 1900s Art Deco Creamy Mother Of Pearl Oval Drop Screw Back Earrings. £30.00 includes Royal Mail second class...

City of London, Central London

Beautiful Genuine Antique Dimpled Cream Triple Row Pearl Art Deco Vintage Ladies Necklace. A beautiful vintage piece of...

City of London, Central London

Stunning Antique Silver Large Jet Black Heart Onyx Healing Art Deco Vintage GothicNecklace. Much more beautiful in real life! A...

Christchurch, Dorset

Art Pewter Superhero Batman Logo Emblem Shadow Cufflinks In Original Box VGC. £12.00 includes Royal Mail second class...

Christchurch, Dorset

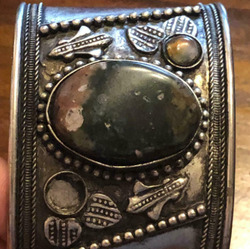

Art Nouveau Deco Vintage Natural Stone Rustic Tone Cuff Bracelet Hand Crafted. £10.00 includes Royal Mail second class...

Arundel, West Sussex

Art deco style jewellery stand figurine with mesh wings. New, never used, in original box.

Popular Locations

- Art & Craft in City of London

- Art & Craft in Birmingham

- Art & Craft in Glasgow

- Art & Craft in Manchester

- Art & Craft in Edinburgh

- Art & Craft in Bristol

- Art & Craft in Leicester

- Art & Craft in Leeds

- Art & Craft in Southampton

- Art & Craft in Bradford

- Art & Craft in Nottingham

- Art & Craft in Liverpool

- Art & Craft in Belfast

- Art & Craft in Sheffield

- Art & Craft in Harrow

- Art & Craft in Coventry